are union dues tax deductible in nj

The Tuition and Fees Education Tax Deduction expired on Dec. UNION DUES CANNOT BE DEDUCTED FROM GOVERNMENT EMPLOYEES IN New Jersey WITHOUT CONSENT.

Union members may still.

. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can itemize deductions. Because of the recent Supreme Court ruling in Janus v. Your contribution cannot be more than 75 of your annual health plan.

Union Members May Opt-Out of Paying Dues. However if the taxpayer is self. However the costs associated with.

31 2020 and has not been renewed for 2021. A reminder for tax season. If youre self-employed you can deduct union dues as a business expense.

Federally health insurance uses pretax funds union dues is subject to expenses in excess of 2 of AGI. These are entered as unreimbursed employee expenses on Line 21 of Schedule A Form 1040 Itemized. However most employees can no longer deduct union dues on their federal tax return in tax.

You would only get a benefit if other factors allowed you to. New Jersey follows the federal rules for deducting qualified Archer MSA contributions. On June 27 2018 the United States Supreme Court issued an important employment law decision in the case of Janus v.

However with the introduction of new tax reforms unreimbursed employee expense. Please note that tax payers can now itemize deductions on state. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and.

The deduction was up to 4000 above the line but barring new. You can deduct dues and initiation fees you pay for union membership. Effective in 2019 union members can NOW deduct their union dues from state taxes provided they itemize deductions.

Blog Union Dues Are Now Tax Deductible. Prior to the 2018 tax year workers were able to deduct union dues check-offs. June 4 2019 1112 PM.

Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union. Dues and any employee expenses not itemized by an employee are no longer tax-deductible regardless of whether they itemize deductions. The dues for persons eligible for active professional or active supportive membership who are on an approved unpaid leave of absence shall be one-half of the full dues.

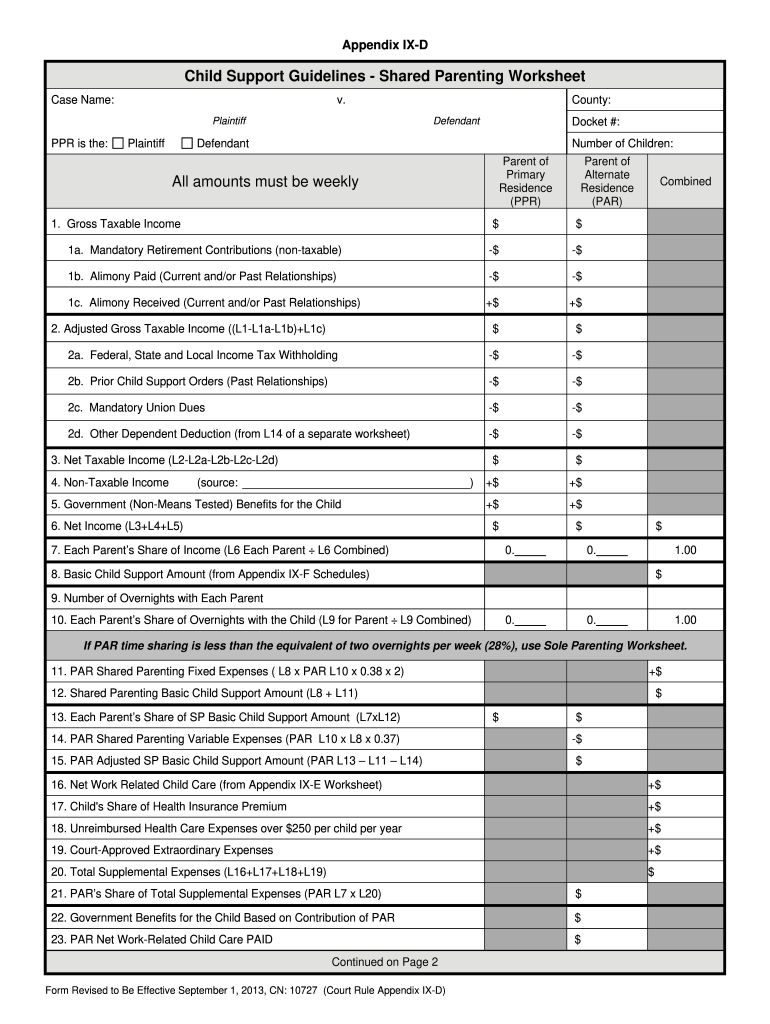

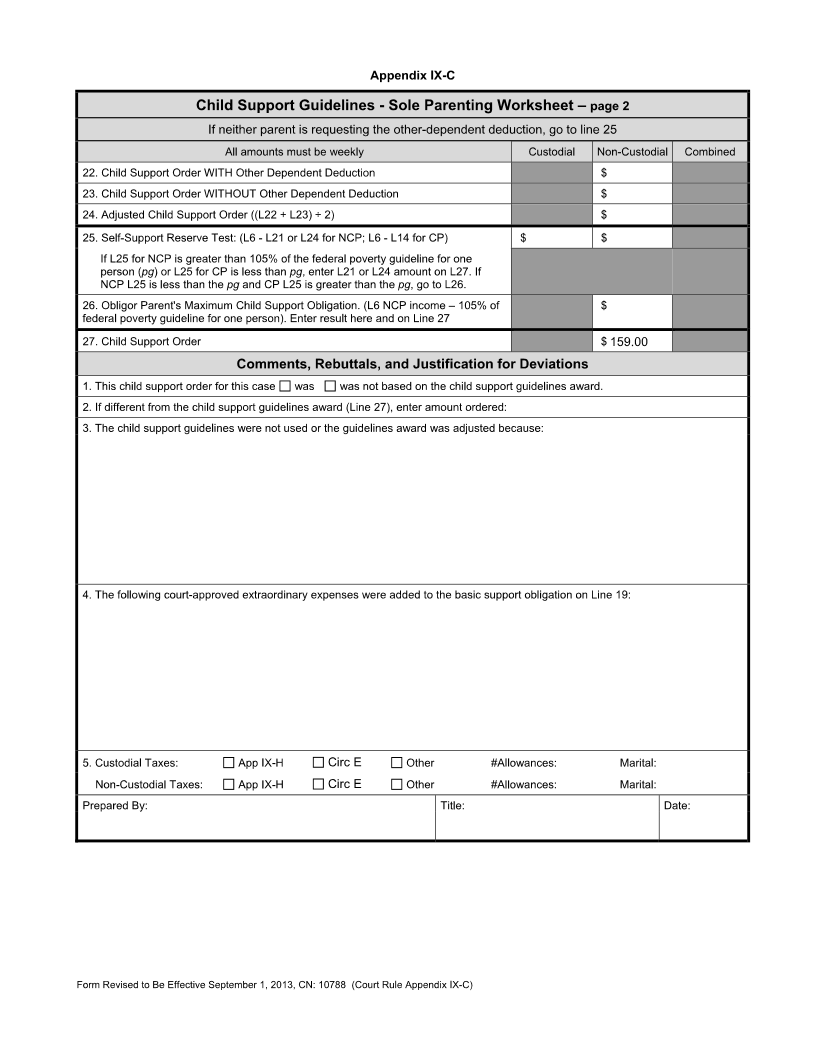

Nj Child Support Guidelines Shared Parenting Worksheet 2013 2022 Complete Legal Document Online Us Legal Forms

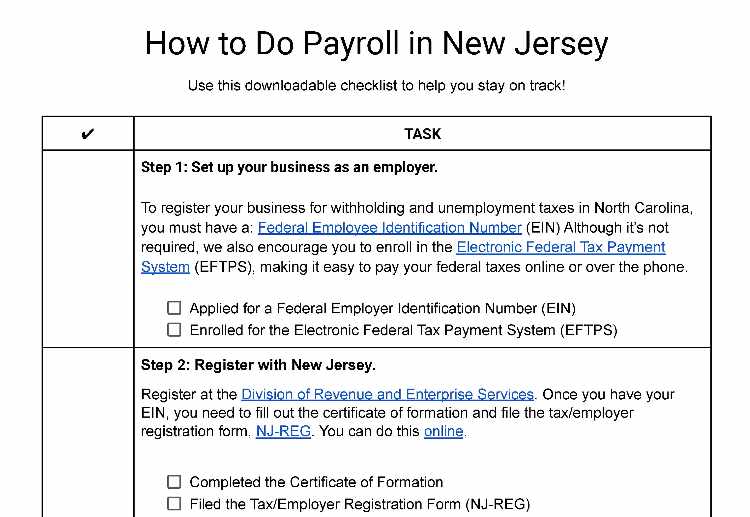

How To Do Payroll In New Jersey Everything Business Owners Need To Know

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

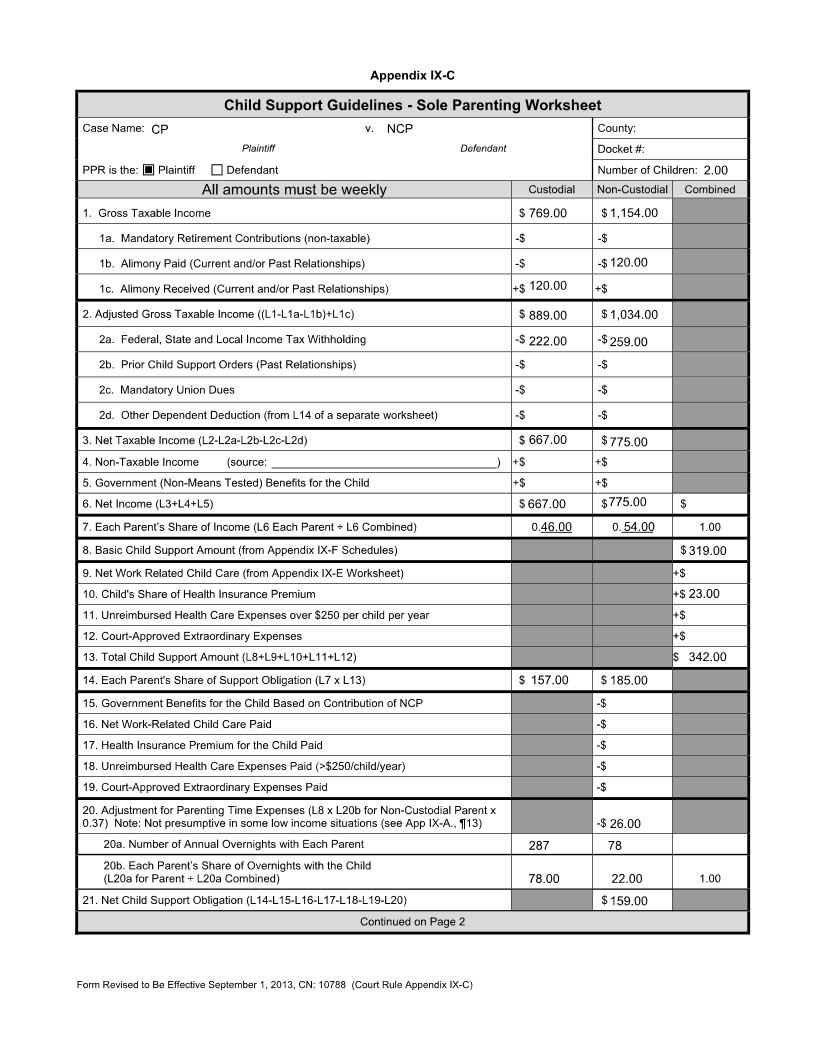

How Much Child Support Will I Pay In New Jersey

New Jersey Sales Tax Guide For Businesses

Union Fees Are They Tax Deductible And What Are They Pop Business

Understanding W 2 Boxes And Codes H R Block

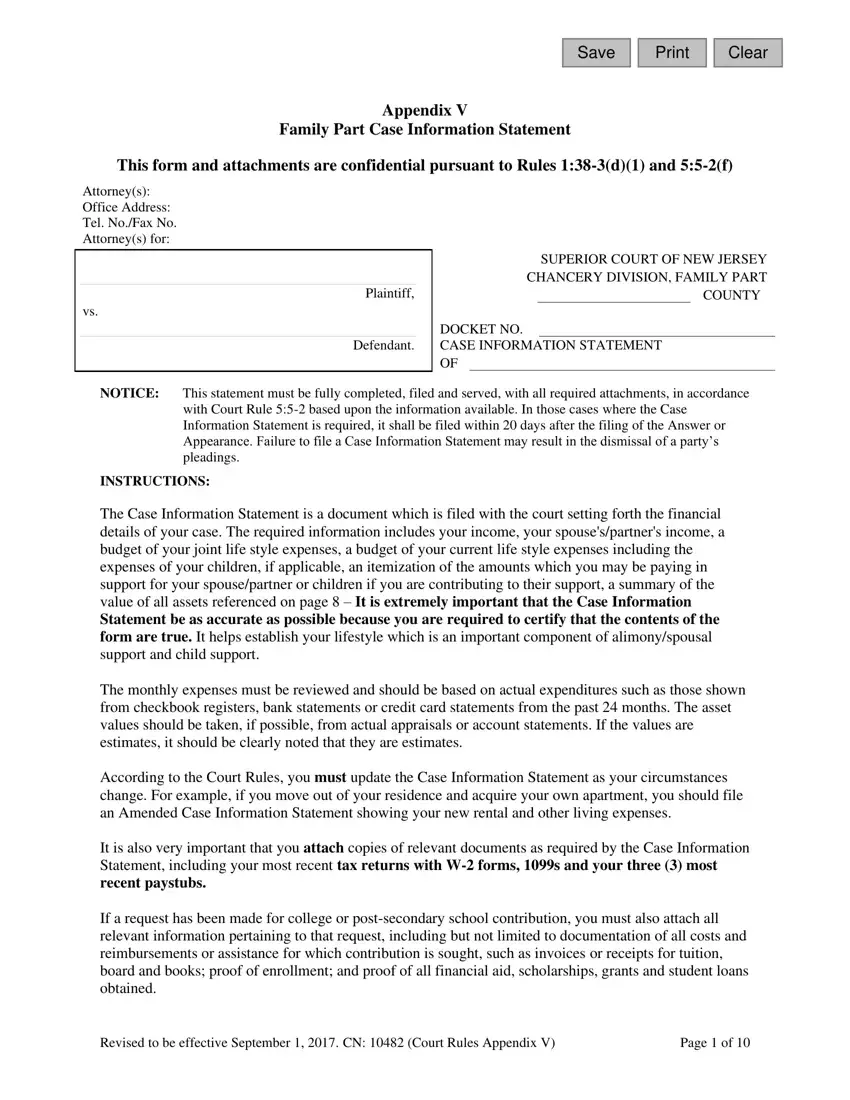

Form Nj Cn 10482 Fill Out Printable Pdf Forms Online

How Much Child Support Will I Pay In New Jersey

Union Dues Are Now Tax Deductible Foa Law

Give Me A Tax Break Union Dues Changes And More On The Horizon Barnes Thornburg

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News

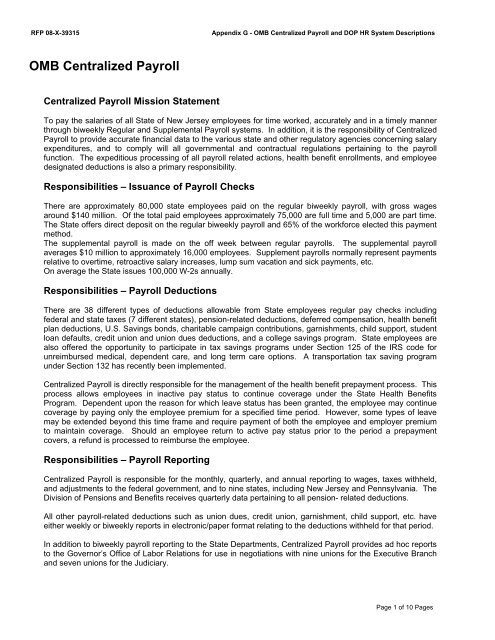

Omb Centralized Payroll And Dop Hr System

Tax Deduction For Union Dues Included In Budget Plan Ballotpedia News