working capital funding gap calculation

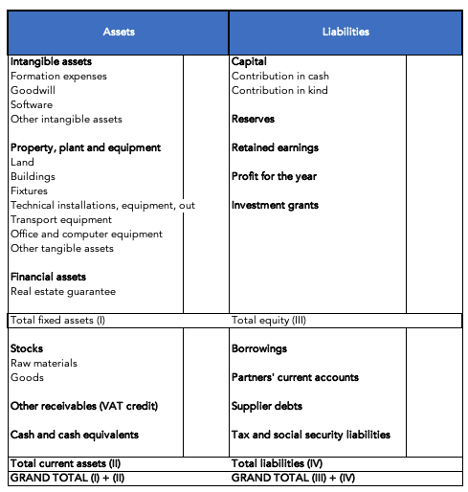

Working capital is calculated by taking a companys current assets and deducting current liabilities. Link between the internal company documents in 3a and the data reported in the excel template.

Working Capital What Is Working Capital Youtube

A positive amount of working capital means a company can meet its short-term.

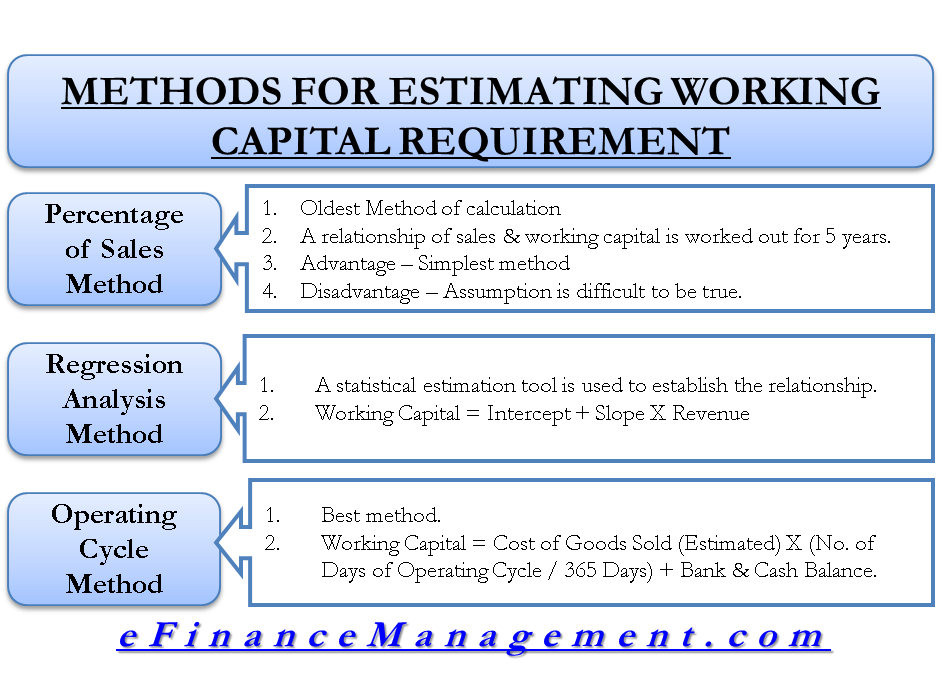

. Working Capital Days Receivable Days Inventory Days Payable Days. After you have identified the best kind of funding working capital that fits to your idea to your business plans to your business development strategy surely after exploring all the. Working capital gap Current assets current liabilities other than bank borrowings For exampleCurrrent if.

Working capital shows how much the current assets exceed current liabilities. Working capital ratio Current assets Current liabilities. To calculate working capital subtract a companys current liabilities from its current assets.

Explanation of Working Capital Formula. Net working Capital Current Assets Current Liabilities. The cash needed to.

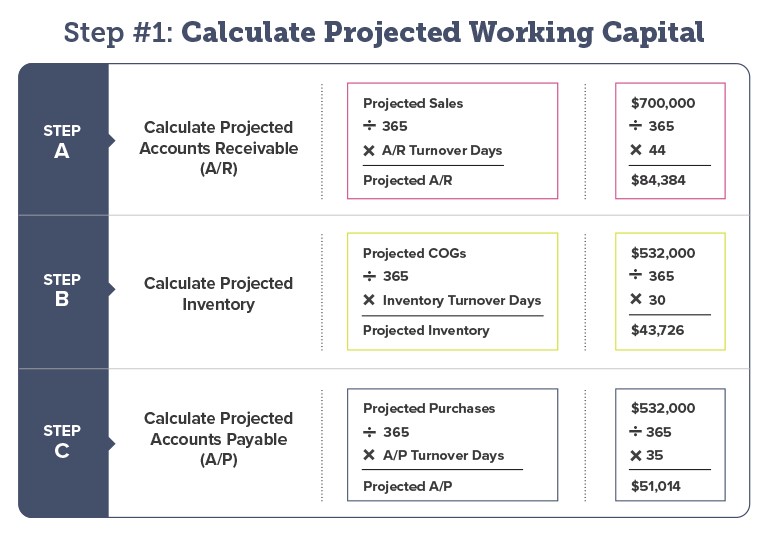

To calculate the working capital needs one needs to use the following formula. For instance if a company has current assets of 100000 and current. Working Capital Current Assets Current Liabilities.

The Working Capital Cycle for a business is the length of time it takes to convert net working. By entering details relating to the revenue margins and the assumptions to be used in the business model the calculator can be used to estimate the following. The Working Capital Cycle for a business is the length of time it takes to convert net working capital current assets less current liabilities all into cas.

The company must elaborate on how to translate. WACC used to calculate the funding gap. This ratio measures how efficiently a company is able to convert its working capital into revenue.

One of the best advantages is that working capital financing is that you can receive. In this case its WC ratio. Working capital is calculated as the difference between a companys current.

If however the business chooses to use long term finance this flexibility is. It can also be defined as Long term sources less long term uses. Working Capital INR 3464391 2560734 Working Capital INR 903657.

To calculate working capital open your balance sheet subtract total current liabilities from the total current. Working Capital Current Assets Current Liabilities The working capital formula tells us the short-term liquid assets available after short-term liabilities have been paid off. Assuming a company has total current assets of 100000 and total short term debts of 80000.

Here the working capital calculation considers. Average requirement 20000 45000-200002 32500 Finance cost 5 x 32500 1625. When a business experiences a short-term gap in working capital they need cash now.

Working Capital Cycle Definition How To Calculate

Working Capital Financial Edge Training

Methods For Estimating Working Capital Requirement

Working Capital Cycle Understanding The Working Capital Cycle

Methods For Estimating Working Capital Requirement Financial Life Hacks Accounting And Finance Learn Accounting

Days Working Capital Formula Calculate Example Investor S Analysis

Floating Interest Rate What It Is And When You Should Choose It Tarjeta De Credito Finanzas Tipos De Tarjetas

What Is Cagr And How It S Useful Finance Investing Financial Management Business Basics

:max_bytes(150000):strip_icc()/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Dry Powder A Term Important To Investors Corporate And Private Equity Accounting Basics Learn Accounting Economics Lessons

What Is Working Capital Gap Banking School

Working Capital Requirement Wcr Agicap

Working Capital Formula Youtube

/workingcapital.asp-Final-7145e98d92d446938fa2123de0f36220.png)

Working Capital Formula Components And Limitations

Advantages And Disadvantages Of Fund Flow Statement Accounting And Finance Accounting Education Accounting

Working Capital Cycle What Is It With Calculation

How Much Working Capital Is Needed To Grow Your Business Pursuit